Millennials, Increase Your Long Term Wealth With Macro Global Investing Ideas

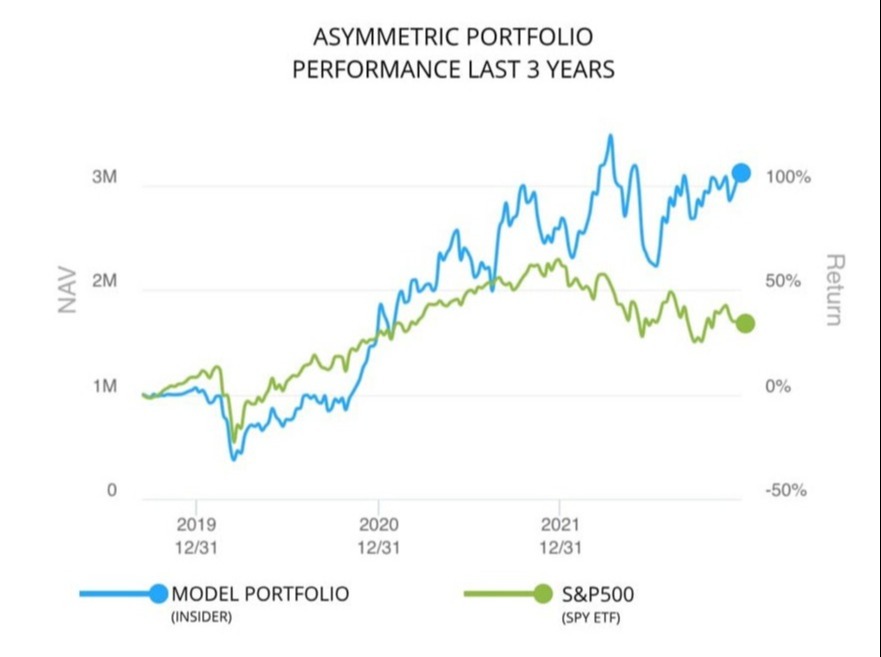

That has helped our subscribers outperform the S&P 500 over the past few years.

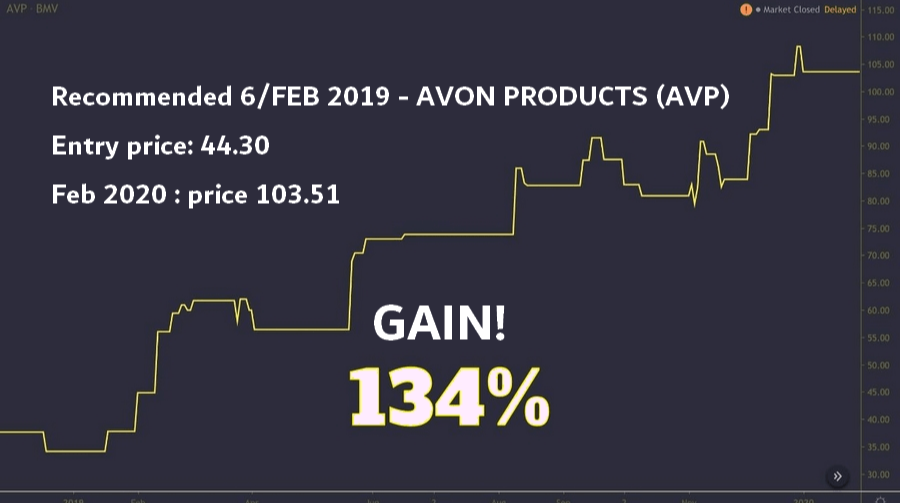

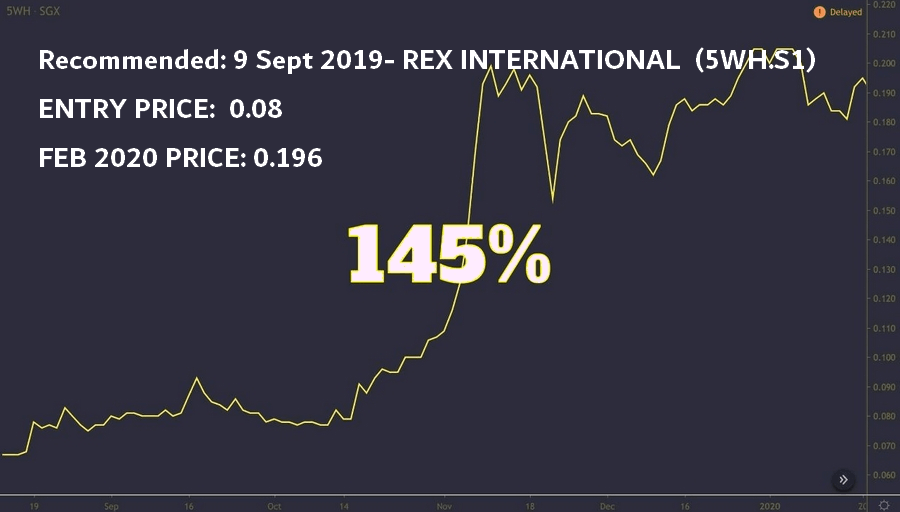

Access the personal investments of 2 hedge fund managers responsible for managing $250 million in client capital since 2016. Done for you, thoroughly researched asymmetric investing ideas targeting high returns and less risk in dozens of global sectors and themes.